This article will discuss how to set up tax regions and tax region zip code tax rates within Lead Commerce.

Tax Regions in Lead Commerce are used to calculate and collect sales tax when orders are placed either through the checkout of the storefront or through the back office (through manual order creation).

You should collect taxes for each state you ship from and to in accordance to their tax laws. This could be origin or destination based sales tax or even sales tax on the shipping total. Lead Commerce allows you to accomplish/record this easily through the creation of ax regions and tax region zip code tax rates on the Sales tab.

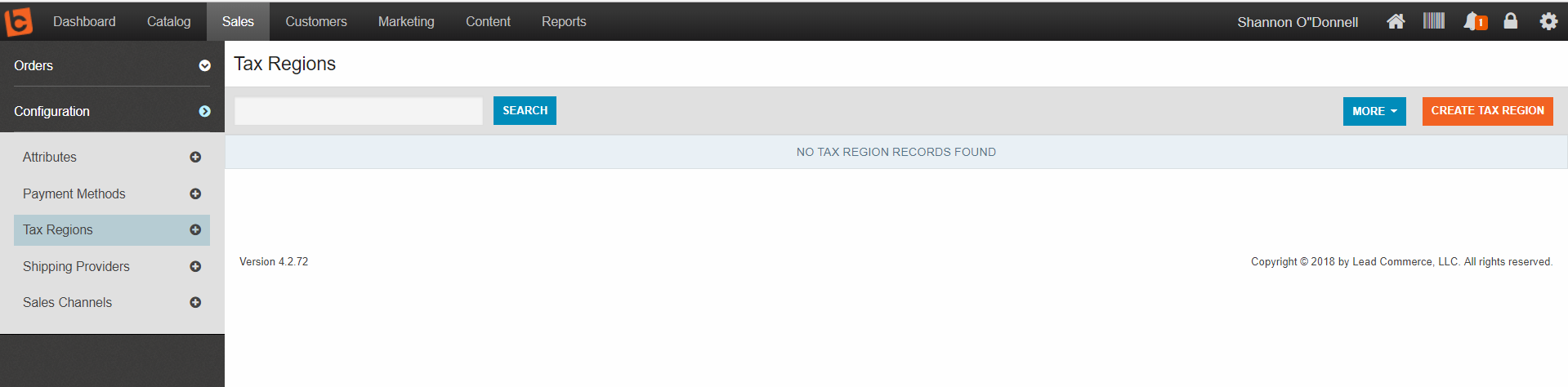

Step One:

Navigate to the Sales Tab> Configuration> Tax Regions. This will bring you to the Tax Region dashboard. Select Create Tax Region.

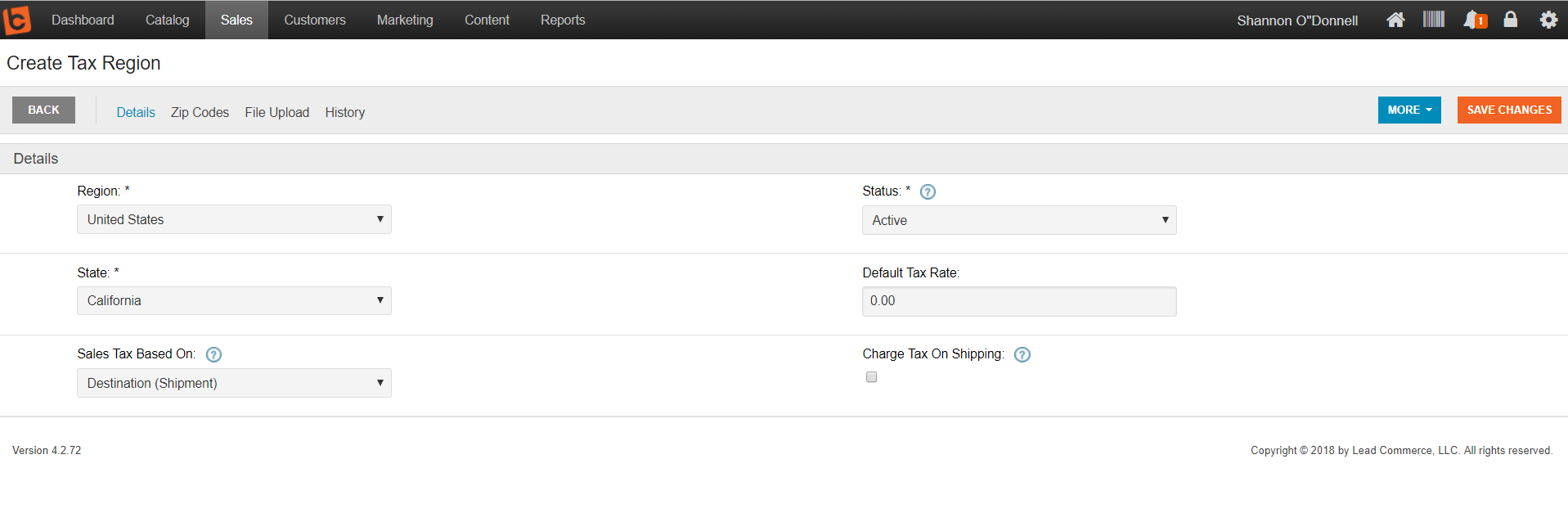

Step Two:

From the Create Tax Region page, you can select the Region (the region that you want to charge sales tax in. This field will dynamically update the State drop down menu). You will update what the sales tax is based on - determined by if the tax is based on the Origin (Warehouse) or Destination (Shipment). Most states are destination based but some states such as California are origin based.

Once you have entered all required and pertinent information, select Save Changes.

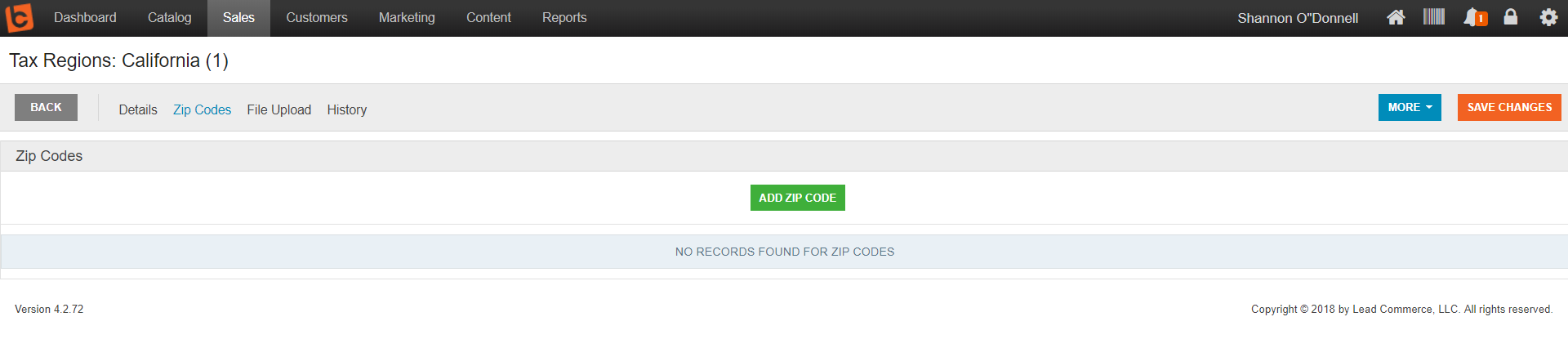

Step Three (Creating Tax Region Zip Codes):

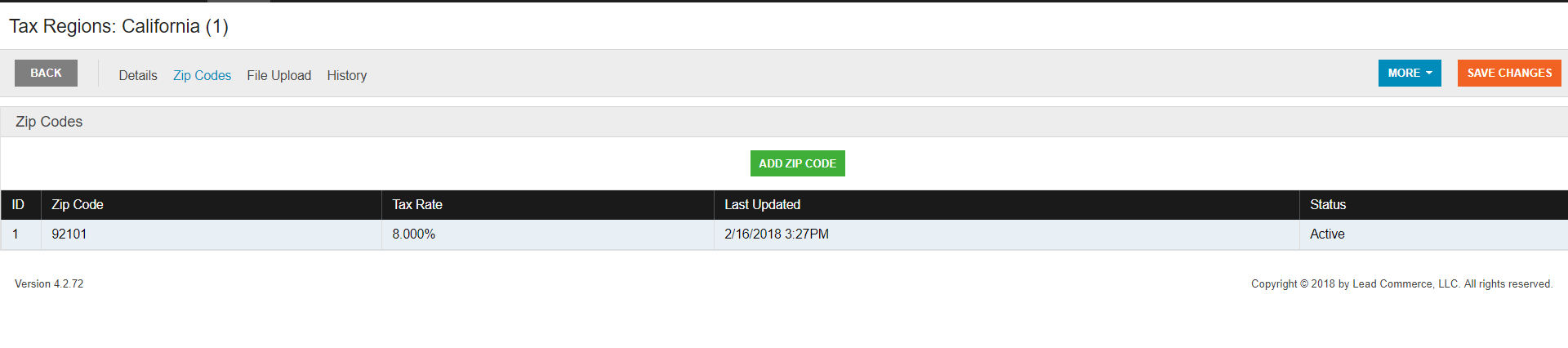

Once you have SAVED your changes to your new tax region, you can now create tax regions based on specific zip codes. Zip Codes are useful if you have to establish different tax rates based on the customer's billing zip code.

Navigate to the Zip Code tab

Select Add Zip Code

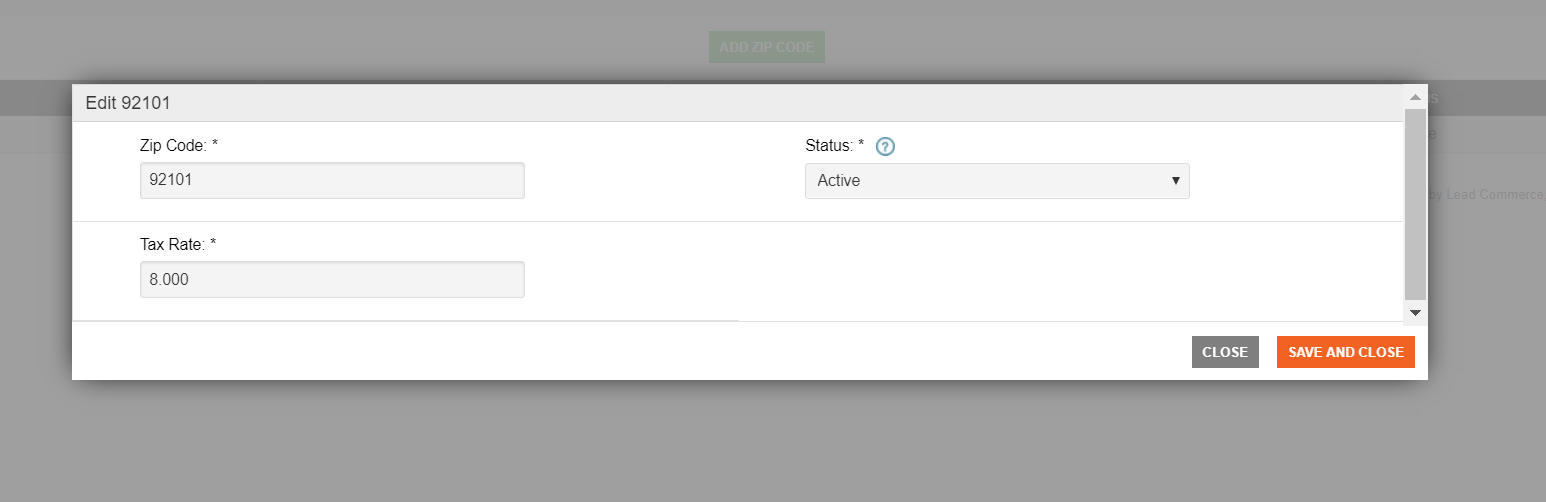

Step Five:

Make sure everything is correct, and save changes.

Made with ❤ in the USA.

Made with ❤ in the USA.